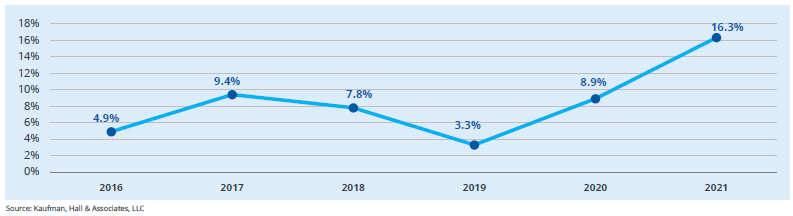

According to the latest M&A report from Kaufman Hall, “throughout 2021, there was one consistent trend in partnership, merger, and acquisition transactions between hospitals and health systems: the number of transactions was down, but the size of transactions was up.” More than 16% of the deals announced in 2021 were “mega mergers,” which Kaufman Hall notes is the largest percentage “in the last six years” – and “almost double the percentage (8.9%) in 2020.”

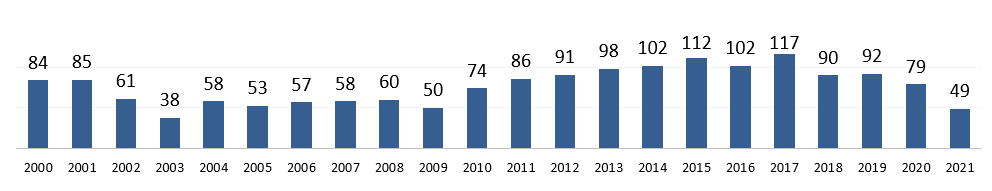

Number of Hospital and Health System M&A Transactions, 2000-2021

Data sources: Adapted from “2021 M&A Year in Review,” Kaufman Hall (Jan 2022) and “2017 M&A in Review,” Kaufman Hall (Jan 2018)

Percentage of “Mega Mergers” – i.e., “Announced Transactions in Which Seller’s (Smaller Party’s) Annual Revenue Exceeded $1B,” 2016-2021

Image source: “2021 M&A Year in Review,” Kaufman Hall, Jan 10, 2022

Why It Matters:

It is important to note that the increased size of hospital and health system M&A events of late translates into more complexity in terms of the organizations involved being able to identify and realize value from the transaction. Even with higher complexity due to a larger percentage of “mega mergers” – and despite the increased scrutiny that hospital consolidation is receiving from the federal government – M&A activity is still certain to continue. In fact, because of the additional complexity, consolidation has become a significant focal point to achieve opportunities, with other strategies such as new construction and joint ventures now becoming more prevalent as well. For any hospital or health system specifically considering an M&A event, the ability to effectively – and realistically – identify the value from bringing the two organizations together is critical. That process goes beyond just assessing how well the two organizations’ services and patient populations complement each other. The combined go-forward organization also needs to meticulously evaluate current business process, payer mix, and financial performance to identify where economies of scale are achievable. Actually achieving those economies of scale is by no means a forgone conclusion though. From a revenue cycle perspective alone, there are a wide range of elements that need to be carefully and deliberately consolidated and standardized (such as CDMs, payer contracts, tax IDs, forgiveness and write-off policies, etc.) in order for the two organizations to truly operate as a single integrated entity. The time and resources required for those initiatives can be significant. Every deal will obviously be different, but the bottom line is that hospitals and health systems need to have a well-defined path for operationalizing the necessary business changes in order to realize any performance value from a merger or acquisition.

This article was originally published in Impact Advisors’ digital newsletter: The Impact Advisor 1Q2022.