Cash management is an area of constant focus for healthcare finance and treasury leaders, with cash reconciliation being the most common audit risk for most organizations.

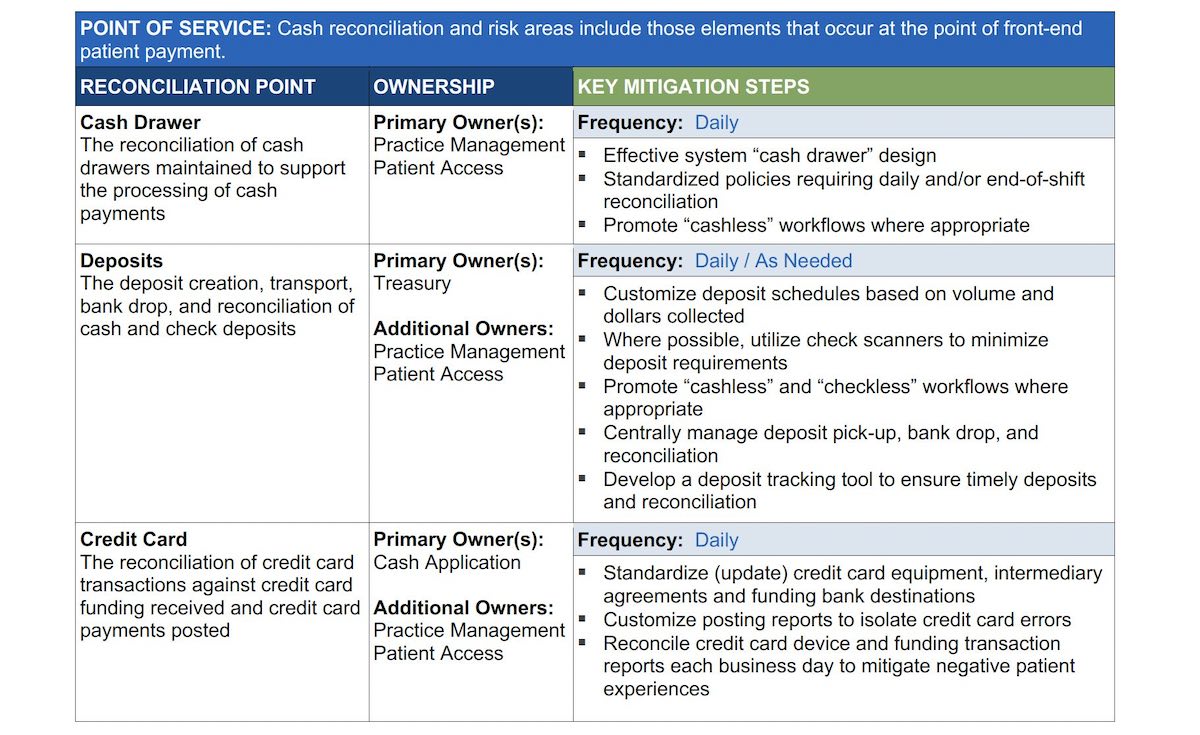

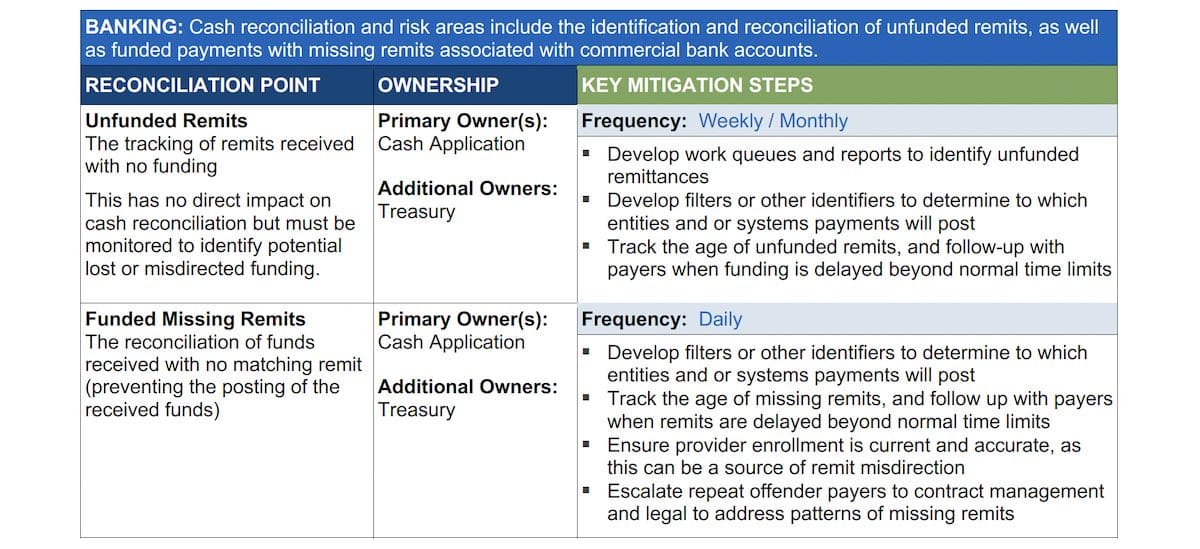

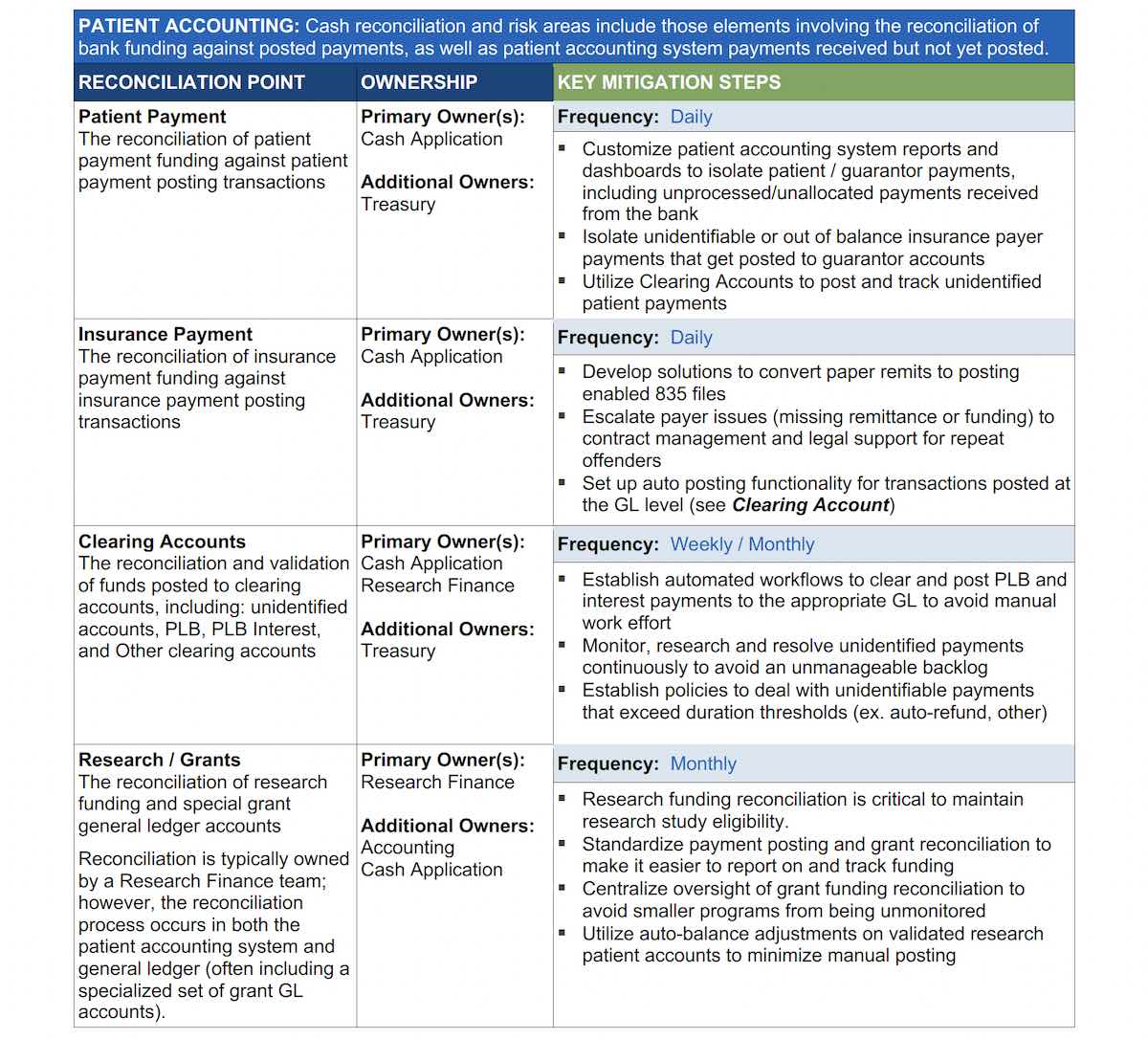

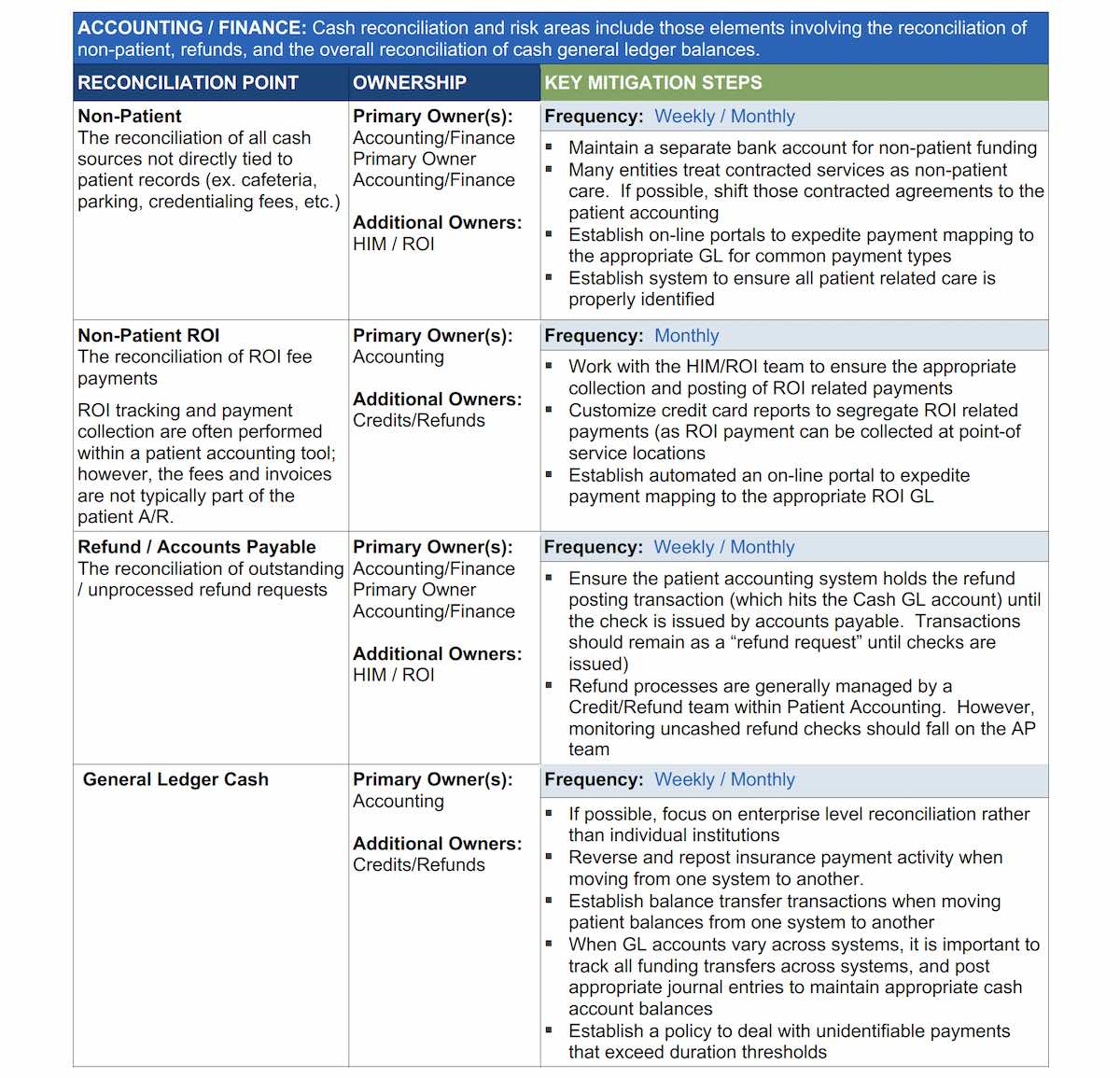

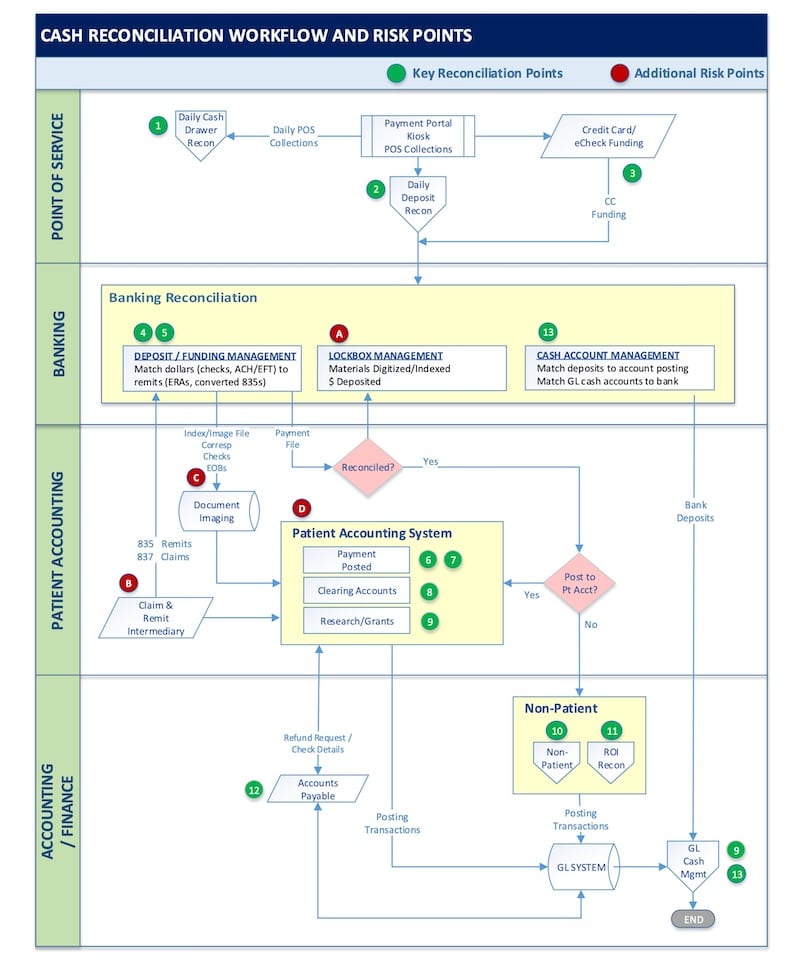

Effective cash reconciliation consists of at least thirteen unique reconciliation points across four operational areas: Point of Service, Banking, Patient Accounts, and Finance/Accounting. The sheer number and method of payment sources, coupled with the fact most cash reconciliation policies and workflows fall outside finance and treasury control, make cash reconciliation one of healthcare’s most complex financial challenges.

This article outlines the key cash reconciliation elements, who should manage them, and the main risks to mitigate.

Key Cash Reconciliation Points

Additional Risk Factors

In addition to continuous monitoring of the individual reconciliation points, there are additional risk factors that can impact the complexity of the reconciliation process. Common risk factors include:

Lockbox / Bank Account Structure

Bank account and lockbox structures are often overly complex and hard to manage, especially after periods of mergers and acquisitions. The more complex the banking structure, the more challenging and unmanageable to cash reconciliation process. During a recent system upgrade, an Impact Advisors client was able to trim the number of bank accounts from 55+ accounts to 7 accounts.

Claim and Remittance Intermediary Files

Most providers utilize a common claim and payer remittance intermediary. By regulation, payers only allow a single intermediary to receive remittance files on behave of a provider. To minimize negative impacts and lost files, maintain local file-sharing network locations for both your claim/remittance intermediary and your bank to upload and receive files for the purpose of cash reconciliation. This ensures that the provider organization maintains ownership and control of remittance and claim files if system issues require the reprocessing or recovery of files.

Document Imaging

It is important to develop appropriate document types to expedite the automated routing and workflows of correspondence that comes in with or without payments attached. Also, the quality and consistency of the lockbox scanning service can impact the posting team’s effectiveness.

Non-Standard / Legacy Patient Accounting Systems

Cash reconciliation is generally much more complex during a new system implementation, or in a circumstance where an organization has multiple patient accounting systems. In each of those scenarios, it is important to have logic built into the banking system programs to separate payment files according to the system they will be posted to. In addition, the general ledger structure is often different in each of these scenarios. It is important to track funding by both bank account and posting system, so the appropriate journal entries can be made each month to maintain the appropriate balances in each Cash GL account. Failure to do so will result in an unreconcilable cash account.

Other Lessons Learned

A few additional lessons learned from our client experiences:

- Conducting an assessment and documenting all current cash management banking, systems, and workflows is an important pre-requisite to taking on a cash reconciliation improvement initiative. Most organizations lack comprehensive documentation on all the factors impacting cash reconciliation.

- Due to the number of departments and resources involved in payment collection, banking, and cash management, it is important to set up standing cross-department cash management work groups.

- Allocating a designated project manager to optimize cash reconciliation will ensure more effective prioritization and communication and will help your initiative stay on track.

If your organization needs more information on navigating cash management policies and workflows, or to get your arms around specific cash management issues, please reach out to us for more information.

Related Readings

Considering Cashless Check-Ins for Your Front Desk?

Preparing for the Migration to RevElate Patient Accounting: Making the Most of the Opportunity

What You Should Know About Surprise Billing to Help Improve Your Patient’s Experience